This article outlines a model for how clients buy. It illuminates the disconnect between where clients spend their “buying time” and where firms spend their “sales and marketing time.”

How does a client become a client? I’ve thought about this for over 20 years. In school, I studied consumer behavior and service experience design. I’ve analyzed the data that flows from web properties (both ours and our clients’). I’ve watched, listened and read much of Clayton Christensen’s work on “Jobs to be Done.” And, I’ve talked to readers of this blog about how they sell. All this to say, I’ve been looking at buying models for most of my agency career.

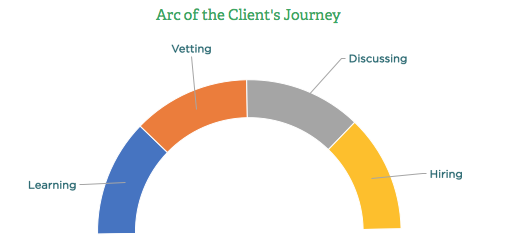

What I’ve found frustrating about decision-making models is that they’re frequently too complex and not helpful in decision-making. A model might explain how people would likely behave, but it was hard to follow. And, it wasn’t prescriptive enough to prioritize marketing efforts. Together, this would make the model too difficult to apply. Long story short — I wanted a model that would make it easier for a firm to prioritize marketing investments. This work became the Arc of the Client’s Journey. The arc represents the 4 stages a client goes through to become a client.

- Learning — Researching a big issue or critical business challenge.

- Vetting — Pre-qualifying potential solution providers.

- Discussing — Exploring their available options.

- Hiring — Negotiating a contract to move forward.

While these activities are presented sequentially, the latest research from Gartner shows that client behavior is not linear; it’s more haphazard. That said, the whole purpose of a model is to simplify complexity. As such, I still believe this model holds up as a way to understand the stages of buying and how to invest your marketing energy. Let’s look at each of the 4 stages briefly:

#1- Learning

Over the years we’ve talked a lot about the explosion of content and the access to information it’s enabled for business decision-makers. Years ago a client might have entered a business discussion without fully researching the issue at hand. Most good clients simply don’t do that anymore. They might rely on a trusted advisor to bring new issues to them. But, frequently they’re either passively learning about topics through trusted channels (industry/business journals, events, LinkedIn) or actively researching solutions to major problems via Google search or their peers. The learning process inevitably leads them to firms that can help them.

#2 – Vetting

Once they’ve framed an issue in their minds, they begin to assess the potential firms that emerge. They look for evidence that those firms have formalized solutions to the problem they’ve identified, that they’ve solved it successfully before, and that they have the talent to solve it again. When people talk about “56% of a buyer’s” decision-making being done before they contact you it’s these first two stages of buying that they’re talking about.

#3 – Discussing

By this point in time, the client feels like they have a strong understanding of the issue or opportunity at hand. And, they feel like they’ve identified a small group of potential firms that could help. This is usually when meaningful conversations begin to happen — directly with potential partners, between senior leaders to establish budgets, and even in clients’ own minds about what has to be done by when. These discussions may be conducted informally (semi-structured dialogues), formally (an RFI), too formally (an RFP), or through a combination of all three.

#4 – Hiring

This is the point in which a client transitions from exploring their options through direct conversation and hiring a selected advisor to move forward. This is when proposals are developed and reviewed. Contracts are negotiated. Teams are assigned. And, schedules are defined.

The Disconnect Between Where Firms and Clients Invest Their Time

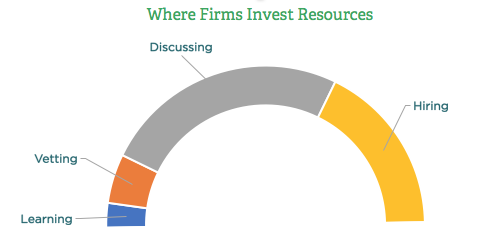

Now, the stages themselves aren’t all that new. But, what really matters is the relationship of the stages to the marketing resources you devote to them. In this case, I’m defining resources as time and money which manifest as sales and marketing activities and technology investments. Ultimately, that is what the model is designed to explain.

A lot of firms place a preponderance of their marketing resources in the last two phases of the process. They lean heavily on practice leaders and business developers to initiate discussions with clients who’ve largely defined their problems and are actively looking for solutions. And, they invest heavily in marketing support functions to support the development of proposals to pursue those opportunities that pass muster. In a lot of firms (especially A/E firms) the investment of resources looks like this:

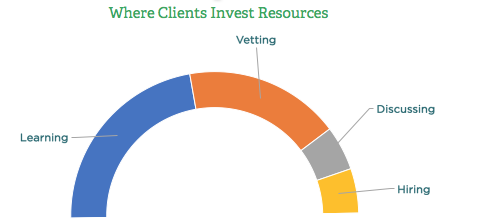

On the surface, this makes sense — the firm is assigning their resources as close to the money as possible. They’re focused on clients that have a clearly stated need and are going to invest resources against that need. Unfortunately, this is typically at odds with where clients invest their time. Most clients will actually spend the preponderance of their resources in the learning and vetting stages:

Clients invest significant time and money to understand the big issues facing their business going forward. They’re looking to identify future-focused marketplace opportunities and looming obstacles that threaten today’s revenue models. Great clients will spend nearly an equal amount of time vetting potential partners. They’re willing to bear their share of the burden to find the right partners. Only then will they invite a handful of potential partners into formal discussions. By contrast, bad clients will simply toss out an RFP to the universe for your firm to respond. That said, both good and bad clients will spend relatively little time actually reading that competitive proposal your team worked so painstakingly hard to develop.

Too Many Firms Under-invest in the Learning and Vetting Stages

This disconnect means that many firms don’t do enough to shape the earliest stages of a client’s buying process:

- They don’t put enough resources into intellectual capital — they don’t have a thought leadership strategy or a compelling point of view on the issues they solve. They under-invest in the first phase of the buying cycle.

- Others are doing the hard work of developing high quality thought leadership. But, they’re not putting enough resources into how they’ll use their thought leadership to progress clients into their next stage of buying. They’re not making it easy for clients to vet them.

And, as I pointed out in this article on the need for firms to market to client wants and needs, your margin shrinks as clients progress deeper into their buying journey. The more you’re affecting the first stage of the buying process with your thought leadership the better your margin. The more effective you are at moving clients through their vetting process and into a conversation, the better your margin. So, if you’re really going to get the most out of your marketing investment, then you need to be really good at moving clients through those first two stages.

Originally published in October 2017, this article was updated in June 2023 to reflect the new research and our latest thinking.